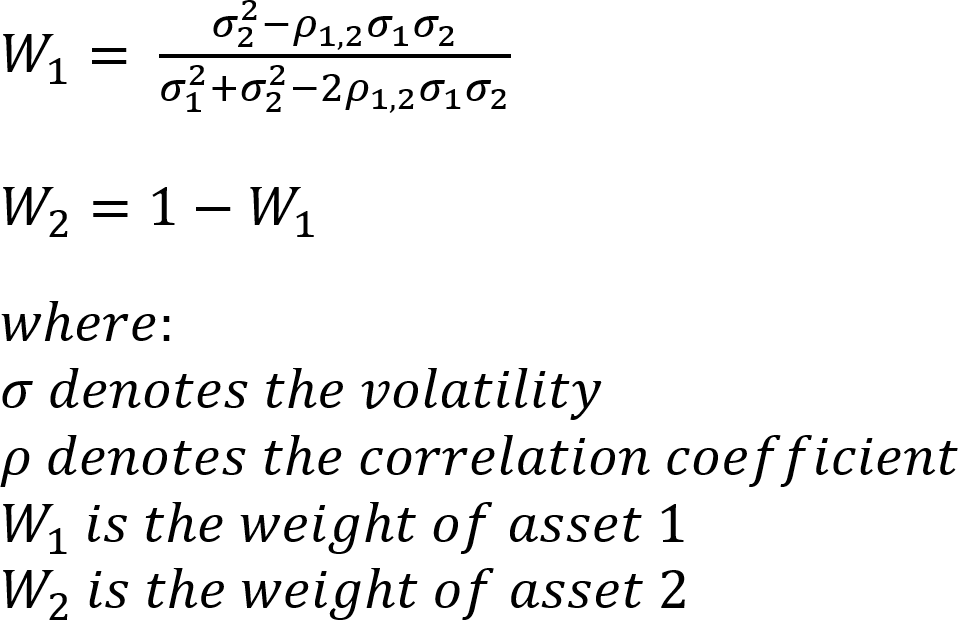

Asset allocation formula

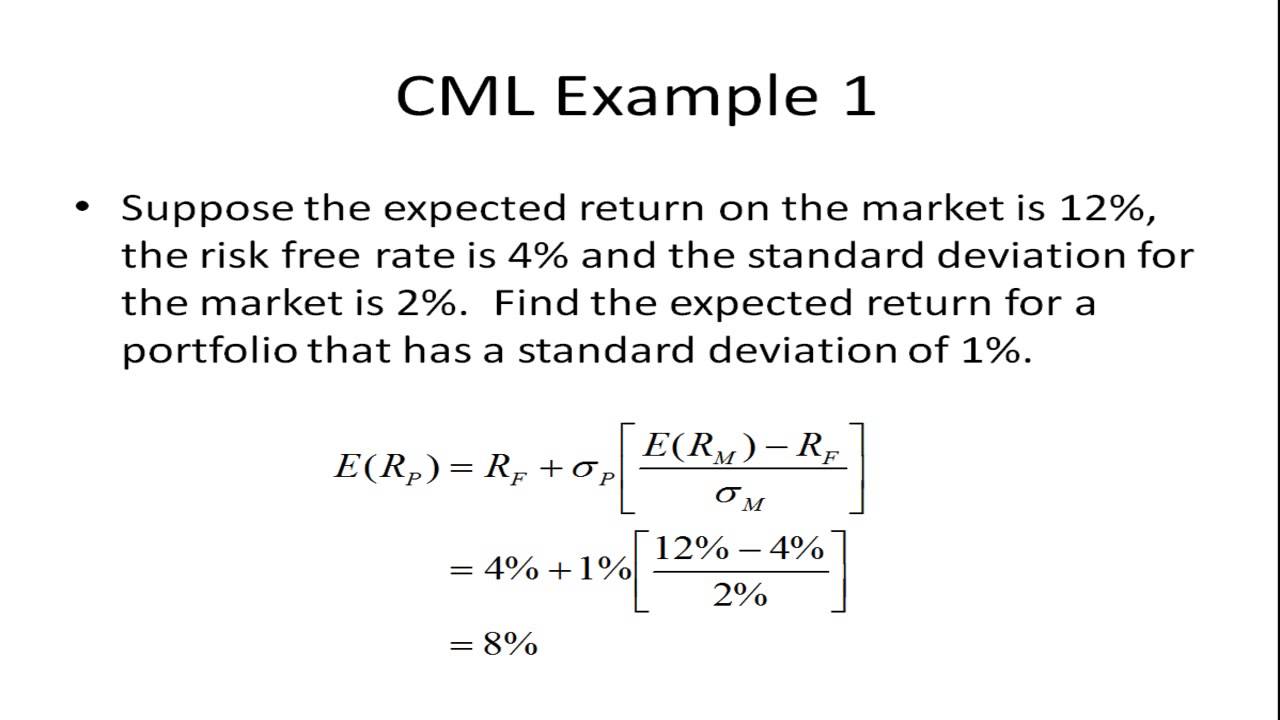

If the investor allocated 25 to the risk-free asset and 75 to the risky asset the portfolio expected return and risk calculations would be. Ad You Need Trusted Resources and The Tools That Can Help You Reach Your Financial Objectives.

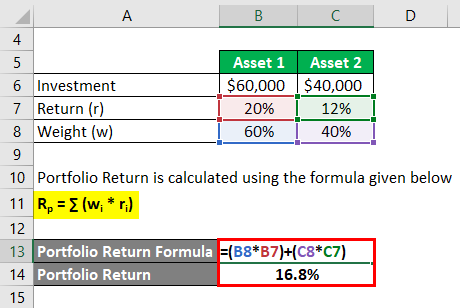

Portfolio Return Formula Calculator Examples With Excel Template

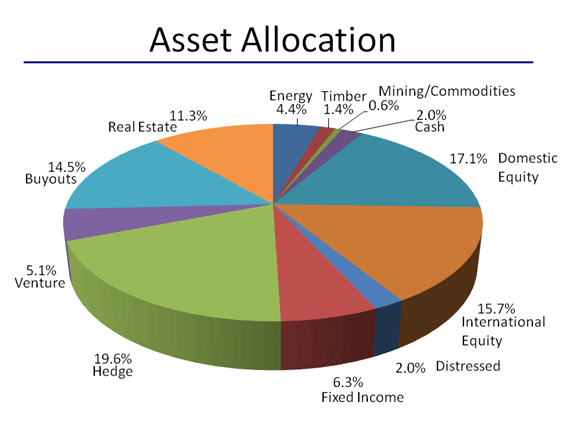

This portfolio might have an allocation in.

. This is because the asset allocation in this type of portfolio is typically fairly well balanced between stocks and fixed income and cash. Plan Prioritize Deliver Your Projects on Time. Allocation Effect Selection Effect 524 324 200 050 250 As we noted the investment decisions generated a positive excess return of 200 basis points bps relative to the.

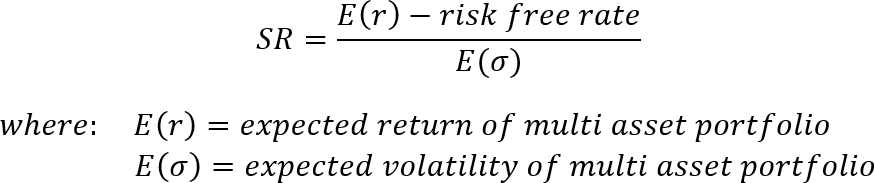

The Asset Allocation Calculator is designed to help create a balanced portfolio of investments. Asset allocation is the value added by under-weighting cash 10 30 1 benchmark return for cash and over-weighting equities 90 70 3 benchmark return for equities. The security selection return results from deviations from benchmark weights.

Age ability to tolerate risk and several other factors are used to calculate a desirable mix of. As a simplistic example Ill use. With this strategy you constantly adjust the mix of assets as markets rise and.

Asset allocation is the implementation of an investment strategy that attempts to balance risk versus reward by adjusting the percentage of each asset in an investment portfolio according. The asset allocation return is the result of deviations from the asset class portfolio weights of the benchmark. Another active asset allocation strategy is dynamic asset allocation.

Percentage of Equity in Portfolio 100 Age of. The Power of Over 85 Years of Investing Experience On your Side. Ad Six Risk-Based Portfolios to Target a Range of Return and Risk Objectives.

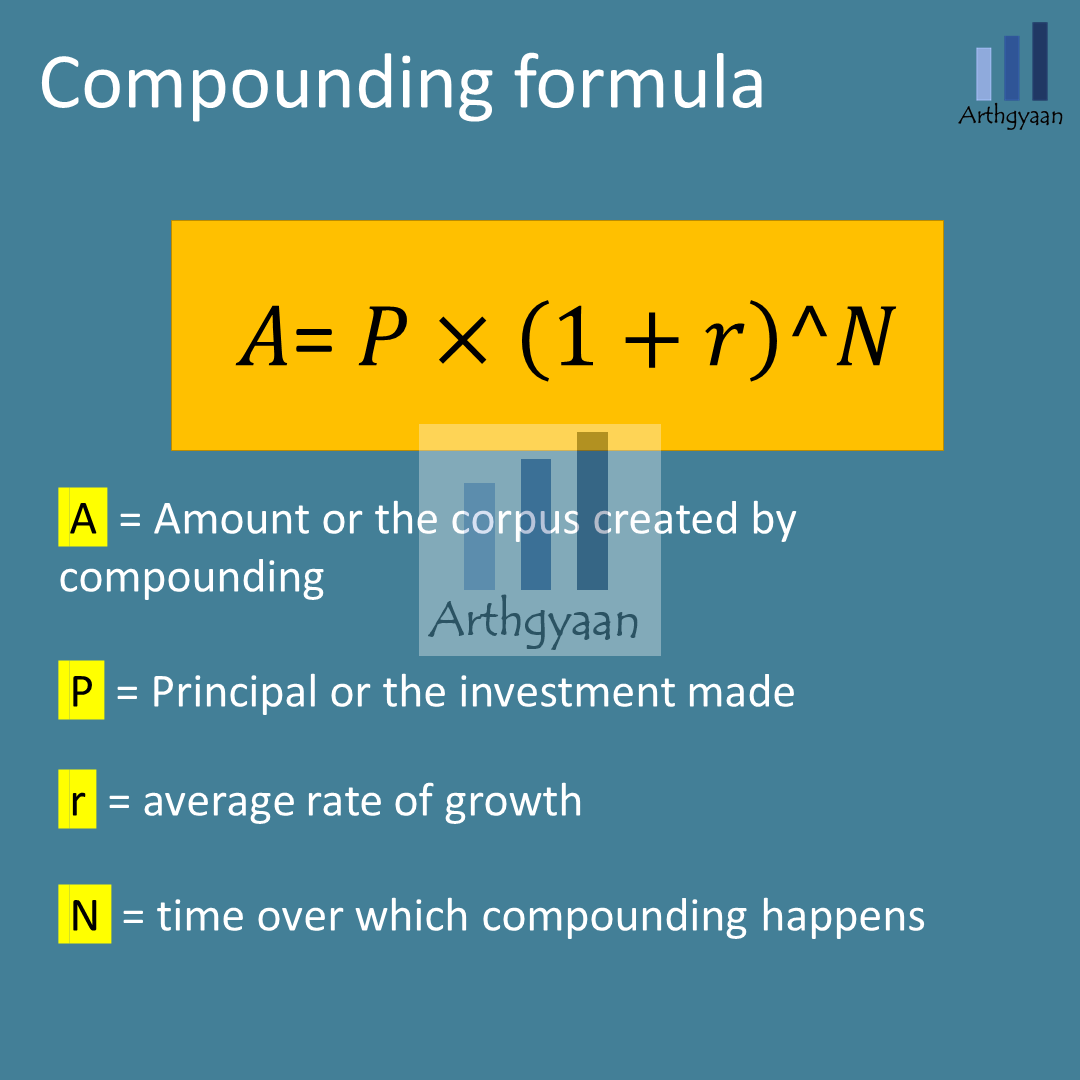

Following asset allocation formula. In the age-based asset allocation technique the investment decision is based on the age of the investor using the following formula. ER of portfolio 3 x 25 10.

Ad Contact Us to Learn More About How Our Capital Allocation Services Can Help. See How American Funds Can Help Improve Client Outcomes Through Objective-Based Investing. See How American Funds Can Help Improve Client Outcomes Through Objective-Based Investing.

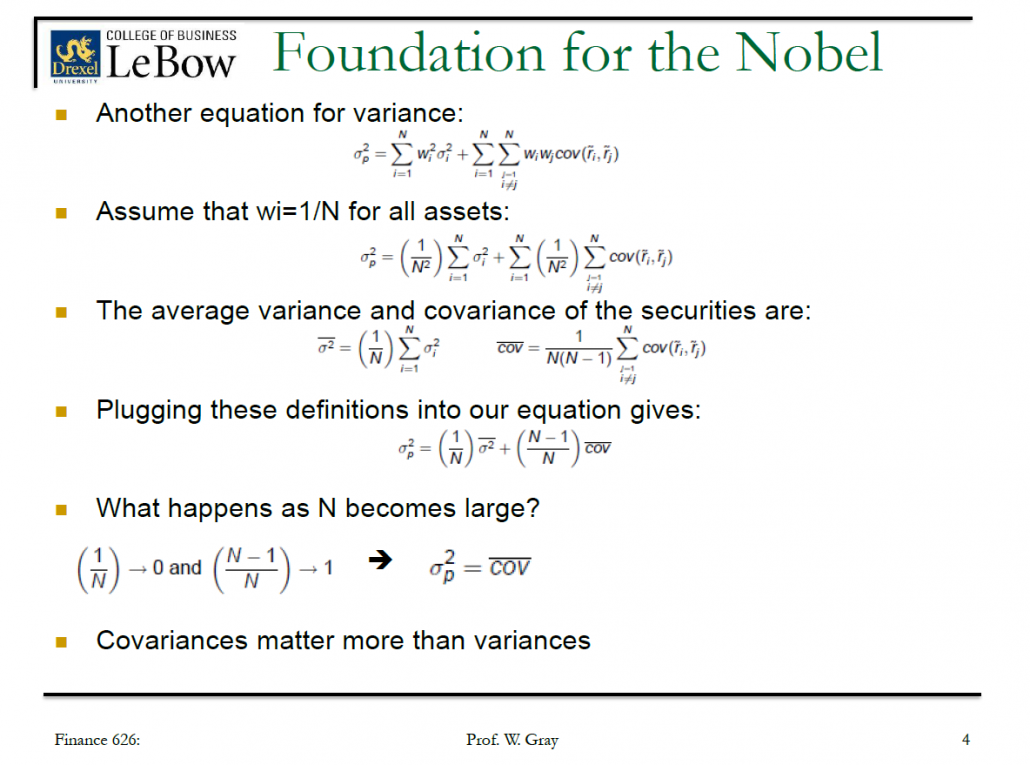

Ad Learn More About American Funds Objective-Based Approach to Investing. Medium risk tolerance age minus 10. Asset allocation is the primary determinant explains 936 of the variation of a portfolios return variability with security selection and market timing together active.

Low risk tolerance age in bonds. To make your allocation decisions easier financial professionals have devised some standard formulas for dividing up your portfolio based on. Delivering Better Decisions Accelerated Results - From Idea to Implementation.

Ad Learn More About American Funds Objective-Based Approach to Investing. The portfolio is rebalanced. Ad Asset Allocation Research Team Provides Advice Based on Economic Research.

Ad Gain The Visibility you Need to Make Informed Decisions Based on Your Teams Workload. High risk tolerance age minus 20. Crafted by Experts and Designed to Capitalize on Ever-Changing Markets.

Strategic asset allocation is a portfolio strategy that involves setting target allocations for various asset classes and rebalancing periodically.

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Asset Management Lecture 15 Outline For Today Performance Attribution Ppt Download

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Solactive Diversification The Power Of Bonds

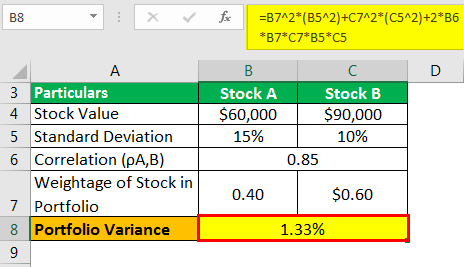

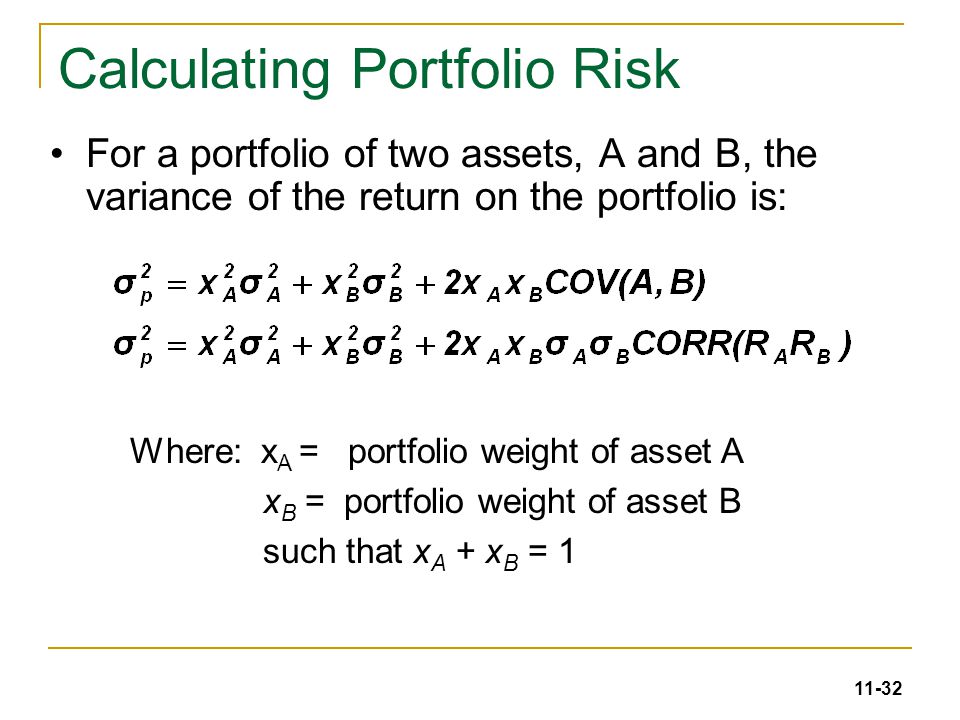

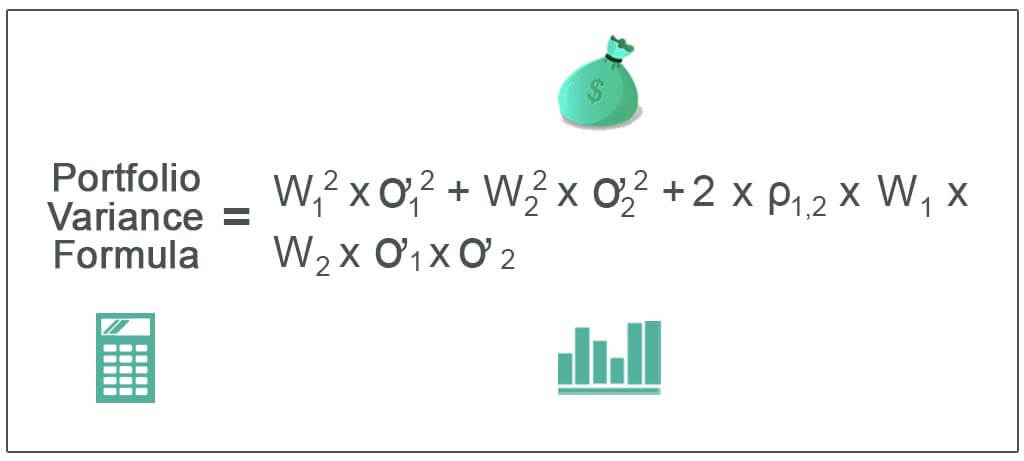

Portfolio Variance Formula Example How To Calculate Portfolio Variance

Standard Deviation And Variance Of A Portfolio Finance Train

Portfolio Optimization From Scratch By Kevin Mekulu The Startup Medium

Lower Risk By Rethinking Asset Allocation Seeking Alpha

Tactical Asset Allocation Beware Of Geeks Bearing Formulas

Chapter 5 Risk And Rates Of Return N

Optimization Formula For Optimal Portfolio Of 2 Assets When No Shorting Allowed Quantitative Finance Stack Exchange

Portfolio Rebalancing During Goal Based Investing Why When And How Arthgyaan

Solactive Diversification The Power Of Bonds

Capital Market Line Youtube

Portfolio Return Formula Calculator Examples With Excel Template

Diversification And Risky Asset Allocation Ppt Video Online Download

Portfolio Variance Formula Example How To Calculate Portfolio Variance